Your Entire Financial Life Working Together

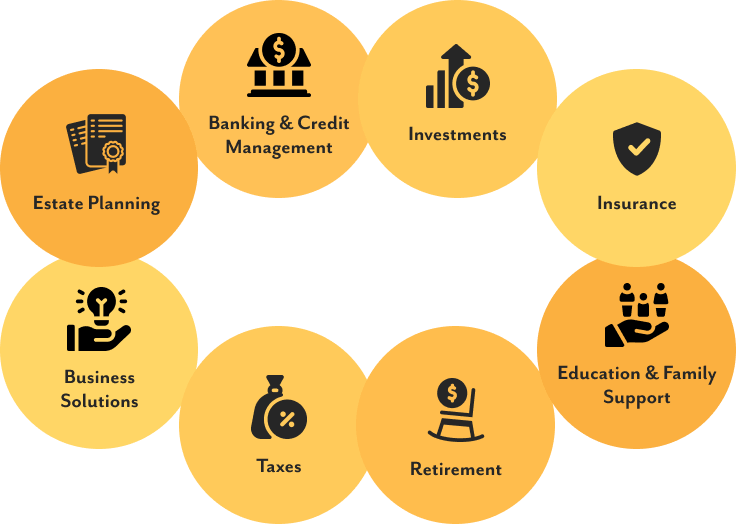

Financial planning is the coordination of every part of your wealth: investments, taxes, estate planning, insurance, and retirement, to help you reach your goals.

At Local Wealth Management, we take the complexity out of wealth management by connecting each area of your financial life into one clear, actionable plan. You get a single, trusted advisor who understands the big picture and the small details so your money works harder, and you worry less.

A Simple, Proven Process

Whether you’re a career professional, preparing to retire, or enjoying retirement, our process keeps things clear and actionable

Discover

Understand your goals, values, and current financial picture

Plan

Design a coordinated strategy across all areas of wealth management

Implement & Adjust

Put your plan into action and adapt over time

Retirement Planning

Plan your cash flow and savings today so your future self has financial freedom. We help you create a retirement income strategy that balances security, flexibility, and tax efficiency.

Investment Management

A disciplined, personalized strategy to grow and protect your wealth. Our approach is tailored to your goals, risk tolerance, and time horizon — no cookie-cutter portfolios.

Strategic Tax Planning

The U.S. Tax code and how the IRS implements it is very complex and ever-changing. We can help you find opportunities to increase your savings by minimizing your tax liability.

Estate & Legacy Planning

Plan your legacy and ensure your assets are distributed according to your wishes. We coordinate with estate attorneys to help create a plan that’s clear, efficient, and tax-smart.

Risk Management & Insurance

Help safeguard your wealth against life’s uncertainties. From life insurance to liability coverage, we design protection strategies that fit your overall plan.

Education & family support

Whether planning for special needs, loved ones, a child's education, or the care for an aging parent, we help design strategies with understanding and utmost care.

Your Life, All Working Together

Most advisors look at each area of your finances in isolation. We coordinate every aspect — investments, taxes, estate planning, insurance, and retirement — so each decision supports the others. This integration saves you time, reduces stress, and increases your long-term results.

Flat Fee. Fee-Only. 100% Transparent.

No percentage of asset fee. No commissions. Just one, clear, flat fee. You’ll always know what you’re paying, for the value you deserve.

Guiding Principle

Financial planning involves coordinating many areas of your financial life, such as estate planning, tax considerations, investment management, and insurance. Too often, these pieces are managed separately, with little communication between professionals. At Local Wealth Management, our role is to take a comprehensive view of your situation and help align each area so that they work together in support of your goals.

Financial Planning FAQ

What's the difference between financial planning and just having my investments managed?

Financial planning is coordinating investments, taxes, estate planning, insurance, and retirement into one actionable plan that evolves with your life.

Investment management is the intentional design of your portfolio based on your goals, preferences, and risk tolerance.

How do I know if all my financial decisions are actually working together?

Most people think they need separate advisors for different things – someone for investments, someone for taxes, and someone for insurance. That approach leaves you isolated.

Everything should flow through one comprehensive financial plan. When your situation changes, your plan changes. That requires an ongoing relationship, not a one-time conversation.

Why should I trust another financial advisor when the industry has so many problems?

We recognize that many people have concerns about the financial services industry, particularly around transparency and advisor incentives. That’s why at Local Wealth Management, we use a flat-fee, fee-only structure and operate as fiduciaries, placing our clients’ interests at the center of the planning process.